Coface Asia Payment Survey 2025 Companies expect payment behaviours to worsen amid economic uncertainty

HONG KONG SAR / SHANGHAI & BEIJING, CHINA / TAIPEI, TAIWAN / SYDNEY, AUSTRALIA / TOKYO, JAPAN - Media OutReach Newswire - 11 June 2025 - The Asia Payment Survey, conducted by Coface in Q1 2025, provides insights into the evolution of payment behaviour and credit management practices of about 2,400 companies across the Asia Pacific region.

Respondents are active in nine markets (Australia, China, Hong Kong SAR, India, Japan, Malaysia, Singapore, Taiwan and Thailand) and 13 sectors.

- Average payment terms rose slightly to 65 days in 2024 from 64 in 2023

- The average payment delay was unchanged at 65 days in 2024 but the share of companies experiencing payment delays dropped to 49%.

- The share of companies reporting ultra-long payment delays (ULPDs[1]) exceeding 2% of annual turnover rose to a new high at 40%, up from 23% in 2023. Wood, Agro-food and Automotive reported the highest increase.

- 57% of companies expect payment behaviours to worsen in the next six months, citing slowing demand, competitive pressure, and rising costs as top risks.

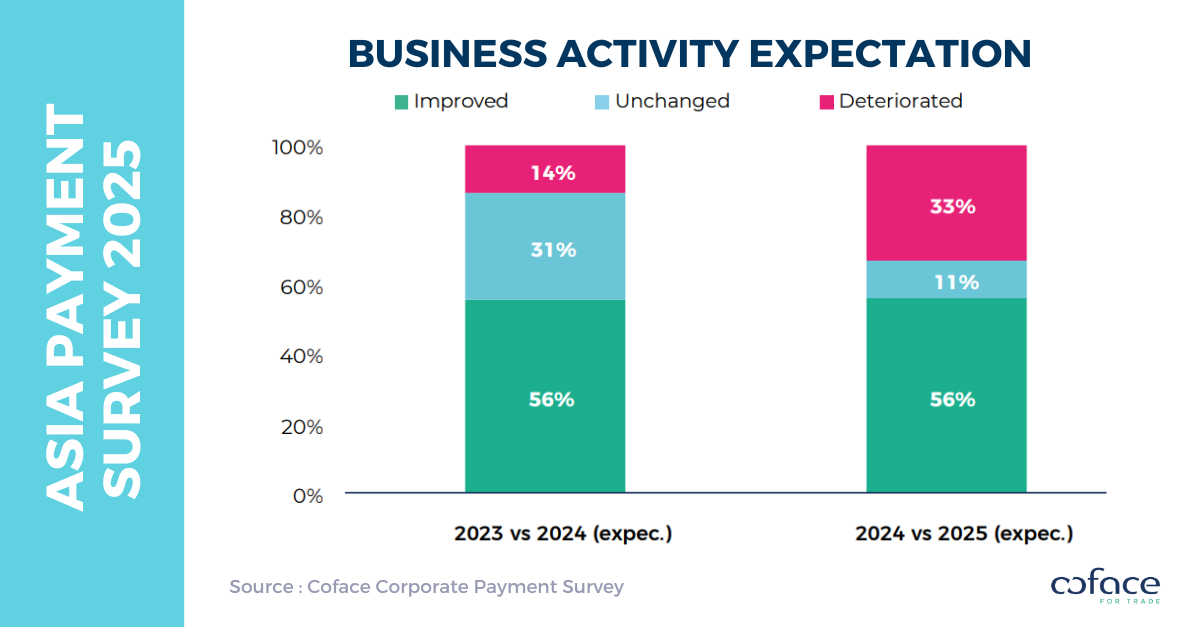

- 33% of companies expected business outlook to deteriorate in 2025.

"Asia-Pacific experienced a slowdown in growth in 2024 due to slow growth in global demand, rising costs and high interest environment. The record surge in ULPDs signals that companies expect to face mounting financial strain. Along with escalating tariffs, businesses are bracing for a more volatile trade and policy environment. We have revised the GDP growth forecast for Asia to 3.8% in 2025. " said Bernard Aw, Chief Economist for Asia-Pacific at Coface.

Credit terms still tight and may tighten ahead

Credit conditions remained tighter in 2024 compared to before 2023. Payment terms rose from 64 days in 2023 to 65 but below the five-year average of 69 days in 2018-2022.

Ten of the 13 sectors surveyed saw their payment terms increase in 2024. The sharpest rise was recorded in the automotive sector followed by textiles and chemicals. Increasing competition in the auto market prompted dealers to be more flexible in granting credit and to use it as a competitive tool.

Looking ahead, two-thirds of companies expect shorter payment terms, reflecting caution and higher priority for cash preservation amid heightened uncertainty.

Rising concern as ultra-long payment delays hit record high

The average payment delay remained stable at 65 days, unchanged from 2023.

Transport and Automobile reported higher payment delays (respectively +2% and +1% vs 2023).

However, the share of companies reporting ULPDs - payment delays over 180 days and exceeding 2% of annual revenue - rose dramatically to a new high at 40%, up from 23% in 2023. This represent a very high risk, given that 80% of these delays have never been paid, according to Coface's experience. Such delays were highest in China, India, Thailand and Malaysia. All 13 sectors also saw increased ULPDs, with the most notable increases in Wood (+37%), Agro-food (+20%) and Automotive (+18%).

This trend is expected to continue over the next six months as 57% of companies expected a deterioration in late payments.

Outlook: Shifting trade policies expected to impact economic sentiment

We expect the economic outlook for 2025 to continue to weaken. Higher tariffs and shifting trade policies have increased uncertainty over global economic policy, weighing heavily on business spending and consumer confidence. In addition, companies also cite over-competitive pressures, slowing demand and higher labour costs as additional risks.

33% of respondents expect business activity to deteriorate in 2025 (vs 2024), more than double as compared to last year's survey. Taiwan and Singapore were the most pessimistic, where over 4 out of 10 respondents expect deteriorating business activity.

'Asia-Pacific growth slowed in 2024 as demand weakened. The rebound in trade last year has marginally offset the decline in 2023. In the face of continued and heightened geo-political uncertainty and increasing costs, many businesses are anticipated to strengthen their credit management measures and prioritise cost management.' said Bernard Aw, Chief Economist for Asia-Pacific at Coface.

Hashtag: #Coface

https://www.linkedin.com/company/coface

The issuer is solely responsible for the content of this announcement.

COFACE: FOR TRADE

As a global leading player in trade credit risk management for more than 75 years, Coface helps companies grow and navigate in an uncertain and volatile environment.

Whatever their size, location or sector, Coface provides 100,000 clients across some 200 markets. with a full range of solutions: Trade Credit Insurance, Business Information, Debt Collection, Single Risk insurance, Surety Bonds, Factoring. Every day, Coface leverages its unique expertise and cutting-edge technology to make trade happen, in both domestic and export markets. In 2024, Coface employed ~5 236 people and recorded a turnover of ~€1.84 billion.