We put forward a way to govern ASIC better. The government said no

- Written by Kevin Davis, Professor of Finance, University of Melbourne

The current governance/management crisis at the Australian Securities and Investments Commission, ASIC has seen a deputy chairman resign and the chairman step aside under a cloud.

It might have arisen simply because of lax internal accounting, compliance, and reporting procedures regarding payments (larger than those approved) benefiting the chairman and deputy chairman (a bad look for a regulator).

Or it might reflect something more substantive about whether the way ASIC is set up is consistent with good governance.

The financial system inquiry set up by the Coalition after taking office examined the governance structure of ASIC in 2014. I was one of members of the inquiry.

ASIC’s governance (and also that of Australian Prudential Regulation Authority, the Australian Competition and Consumer Commission and other statutory authorities) is built around a “commission” structure.

A small group of full-time executives (appointed by the government as “commissioners” and one designated as the “chairman” or chief executive) are responsible for both the governance and management of the organisation.

Read more: ASIC chair James Shipton steps aside after adverse finding by Auditor-General

This contrasts with the conventional corporate structure found in the private sector where a board (in theory appointed by the shareholder owners, but often a self-perpetuating “mates club”) is separate from the day-to-day management of the business which is undertaken by the chief executive and other full-time employees.

The board is responsible for monitoring company performance, determining strategy (including approving funding plans), and hiring and firing the chief executive.

We considered carefully the best way to run ASIC

In considering the governance structure we noted that a board structure involving part-time external directors was put in place when the Australian Prudential Regulation Authority was established in 1998 but discarded after a few years.

This reflected the recommendation of the royal commission into the collapse of HIH insurance, which concluded that the board structure had blurred accountability between management and the board.

Our inquiry (the Murray financial system inquiry) also decided that a board structure was not appropriate.

What was needed was oversight

Why not? Well, it is very hard to imagine the federal treasurer giving up the powers to appoint (and sack) the chief executive, determine the funding level, and set mandates and performance objectives. In practice the board would have little to do.

In fact all that would really be left would be monitoring the performance of the regulator.

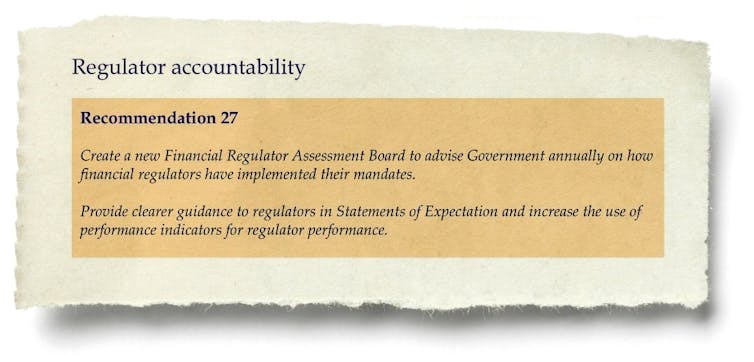

While the regulators are required to report to the minister and are monitored in other ways (including by the audit office) we came to the view that a separate overarching Financial Regulator Assessment Board (FRAB) would be the best way to oversee the performance of all of the regulators.

Although the treasurer could do this, we came to the view that in practice things would slip under that treasurer’s radar.

Financial System Inquiry final report, November 2014

It was one of the only two (out of 44!) recommendations rejected by the government.

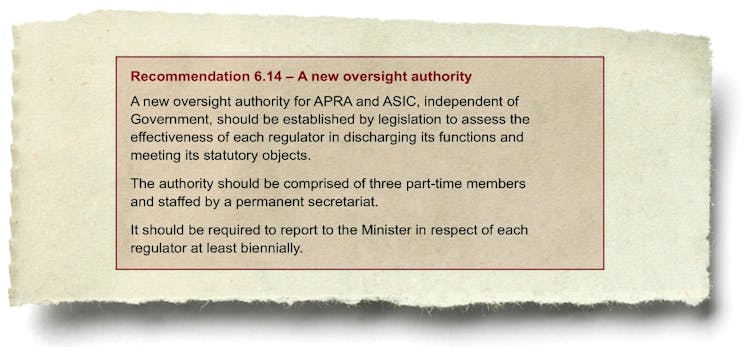

But it has resurfaced as a recommendation of the Hayne royal commission into misconduct in the banking, superannuation and financial services industries.

Recommendation 6-14 is for the establishment of a new oversight authority, differing in some details from our recommendation, but otherwise similar.

Financial System Inquiry final report, November 2014

It was one of the only two (out of 44!) recommendations rejected by the government.

But it has resurfaced as a recommendation of the Hayne royal commission into misconduct in the banking, superannuation and financial services industries.

Recommendation 6-14 is for the establishment of a new oversight authority, differing in some details from our recommendation, but otherwise similar.

Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry final report , February 2019

In its response to the Hayne report the government accepted this recommendation, despite having earlier rejected ours.

Consultation on draft legislation to set up such a body took place in early 2020, but the bill has not yet been brought to parliament.

Whether having such an oversight authority will help resolve ASIC’s internal management and governance failings is an open question.

The current structure isn’t helping

In the 2015 ASIC Capability Review (led by Karen Chester – subsequently appointed as an ASIC Commissioner), a significant recommendation was to “realign its internal governance structure to achieve a clear separation of the non-executive (governance) and executive line management roles”.

The primary focus of the commissioners would become “setting the strategy of the organisation and supervising overall delivery and performance against the strategy, along with making, and taking ultimate responsibility, for key regulatory decisions”.

Read more:

It's about to become easier to lend irresponsibly, to help the recovery

Commissioners would no longer be in charge of individual divisions, a change ASIC later adopted in 2018.

Has it worked? If reports on internal ASIC conflicts in the media are to be believed, not really.

The proposed assessment authority wouldn’t help with uncovering compliance failings such as those prompting the current crisis – they remain the responsibility of the auditor.

Our idea could help put it right

But it would help with the broader goal of ensuring ASIC is working well.

Its remit would include how ASIC’s governance and management arrangements enable it to achieve the mandate and performance expectations set for it by the government.

Whether the government will go beyond a knee-jerk reaction to the current scandal and actually adopt such a more considered approach is anyone’s guess!

Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry final report , February 2019

In its response to the Hayne report the government accepted this recommendation, despite having earlier rejected ours.

Consultation on draft legislation to set up such a body took place in early 2020, but the bill has not yet been brought to parliament.

Whether having such an oversight authority will help resolve ASIC’s internal management and governance failings is an open question.

The current structure isn’t helping

In the 2015 ASIC Capability Review (led by Karen Chester – subsequently appointed as an ASIC Commissioner), a significant recommendation was to “realign its internal governance structure to achieve a clear separation of the non-executive (governance) and executive line management roles”.

The primary focus of the commissioners would become “setting the strategy of the organisation and supervising overall delivery and performance against the strategy, along with making, and taking ultimate responsibility, for key regulatory decisions”.

Read more:

It's about to become easier to lend irresponsibly, to help the recovery

Commissioners would no longer be in charge of individual divisions, a change ASIC later adopted in 2018.

Has it worked? If reports on internal ASIC conflicts in the media are to be believed, not really.

The proposed assessment authority wouldn’t help with uncovering compliance failings such as those prompting the current crisis – they remain the responsibility of the auditor.

Our idea could help put it right

But it would help with the broader goal of ensuring ASIC is working well.

Its remit would include how ASIC’s governance and management arrangements enable it to achieve the mandate and performance expectations set for it by the government.

Whether the government will go beyond a knee-jerk reaction to the current scandal and actually adopt such a more considered approach is anyone’s guess!

Authors: Kevin Davis, Professor of Finance, University of Melbourne

Read more https://theconversation.com/we-put-forward-a-way-to-govern-asic-better-the-government-said-no-149002