After the election: Assessing Investor Sentiment in Hong Kong and Singapore Post-Trump's Election

Hong Kong and Singapore investors plan to increase investment allocation to the US market by 3% to 5% next year

- Survey by MDRi highlights rising concerns in Hong Kong and Singapore about the deteriorating US-China relationship following Trump's election

- Hong Kong investors exhibit greater confidence in the US market, contrasting with a more cautious outlook from Singaporean investors

- Investment decisions are influenced by market volatility, interest rate changes, and perceptions of Trump's economic policies

HONG KONG SAR - Media OutReach Newswire - 19 November 2024 - In the wake of Donald Trump's election as the next US President, a recent survey conducted by MDRi, a business insights provider, reveals significant differences in investor sentiment between Hong Kong and Singapore.

The survey, which included 500 participants from each market, sought to understand the implications of the US election outcome on regional economic perspectives.

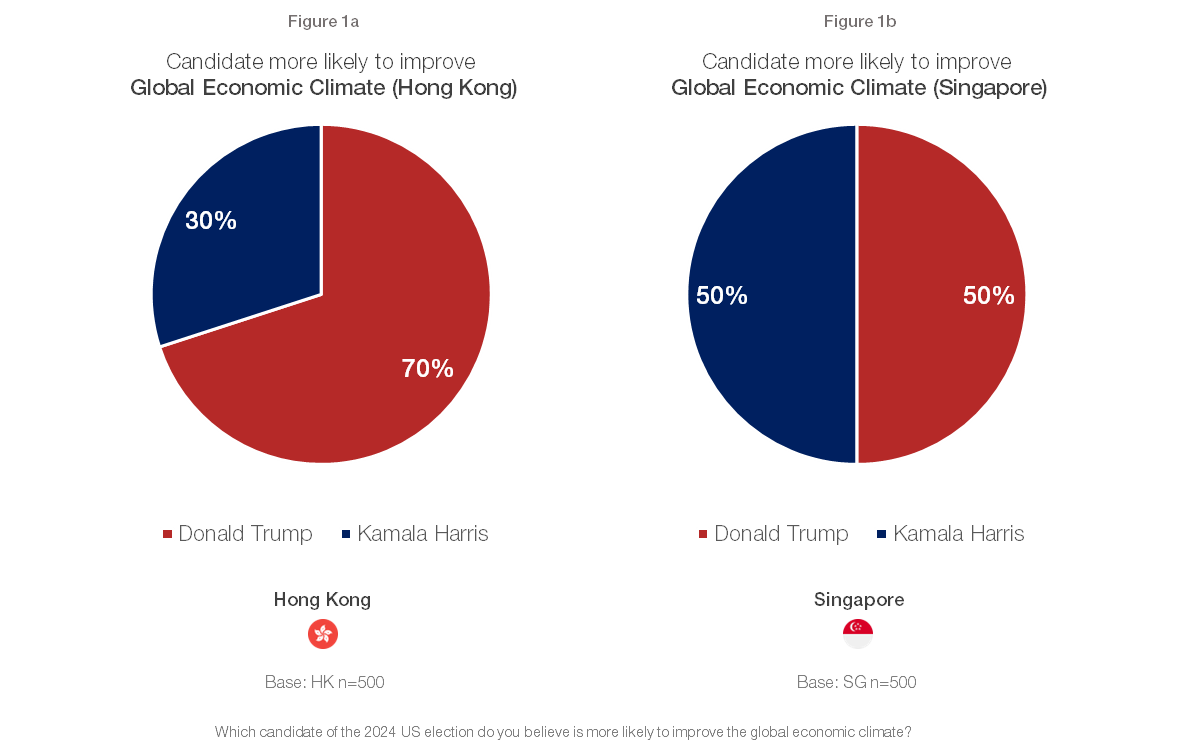

In this survey, respondents from both markets were asked to identify the candidate they believed would most likely enhance the global economic climate. A striking contrast emerged between the two markets: while a significant 70% of individuals in Hong Kong favoured Donald Trump, only half of the respondents in Singapore shared this view (See figures 1a and 1b).

Both the Hong Kong and Singapore markets recognize the significant influence of the US-China relationship on their local economies' growth trajectories, with 44% in Hong Kong and 46% in Singapore acknowledging its importance (See figure 2).

However, there is a shared concern in both markets regarding the potential deterioration of the US-China relationship following Donald Trump's presidency, with 40% in Hong Kong and 46% in Singapore expecting it to worsen (See figure 3).

Among Hong Kong millennials aged 30-44, 35% anticipate a worsening of US-China relations— slightly lower than the overall average of 40%. Conversely, older generations in Singapore display heightened concerns, with 53% of those aged 45 and above fearing negative consequences, compared to the total average of 46%.

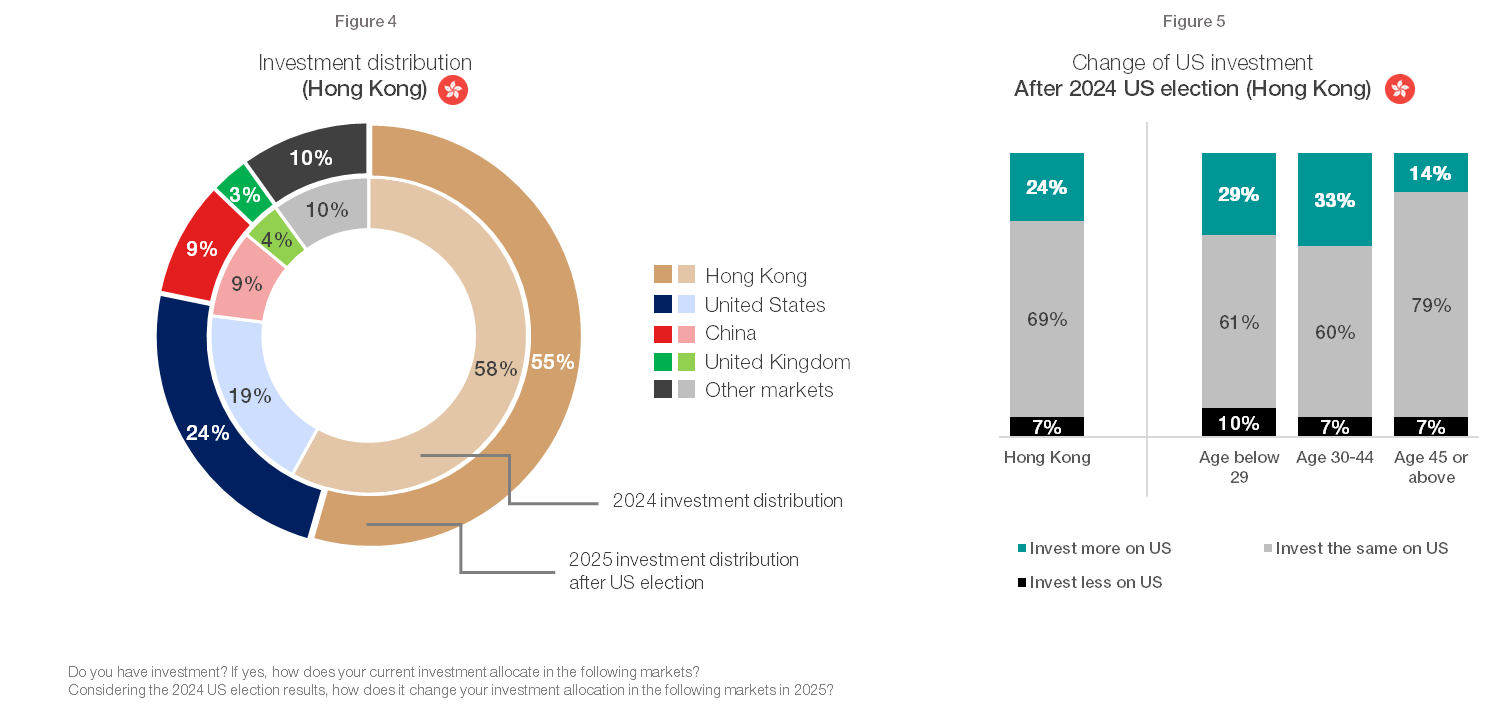

Among Hong Kong investors, the bulk of their investments are currently allocated to the Hong Kong market (58%), with the US market following behind at 19%. Following the 2024 US election and a heightened sense of optimism towards the global economy, there is a notable shift in investment plans among Hong Kong investors for 2025, with a planned increase in investment allocation to the US market (rising from 19% to 24%, see figure 4).

24% of Hong Kong investors plan to invest more in the US market. And when we compare to the older age group, Gen Z and Millennials intend to invest more in the US market after the 2024 US election (See figure 5). The shift in investment from the Hong Kong market to the US market reflects a growing confidence among younger investors in the US economy, coupled with a sense of pessimism regarding the local economic outlook.

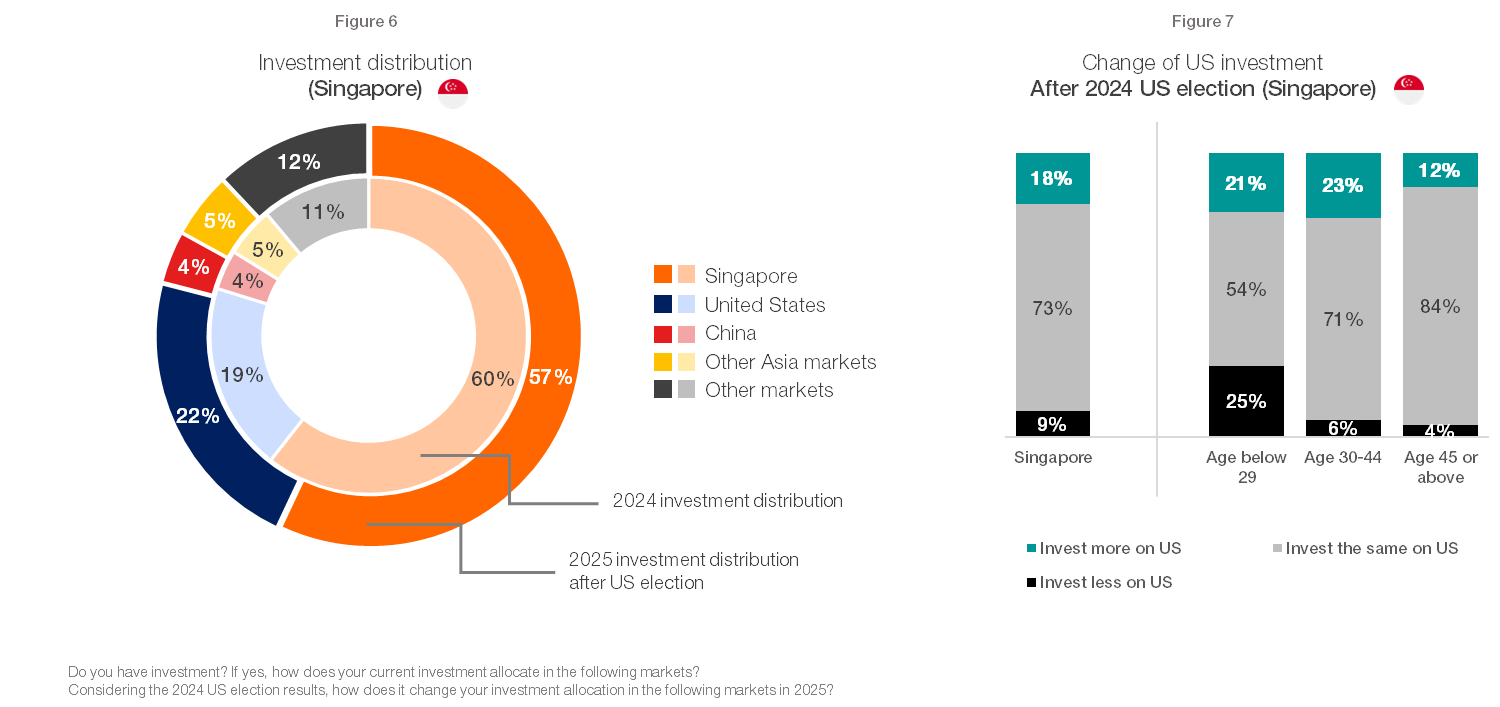

Similarly, Singaporean investors are displaying a comparable investment trend. Currently, 60% of their investments are allocated to the local Singapore market, while the US market comprises 19% of their portfolio. Following the 2024 US election, there is an increasing interest among Singaporean investors to boost their US market investments, with the allocation projected to rise from 19% to 22% (See figure 6). Notably, 18% of Singaporean investors plan to increase their US investments in 2025 after the election (See figure 7).

Both Hong Kong and Singapore investors are exhibiting a shift in investment sentiment towards the US market following the 2024 US election. This shift underscores a growing confidence among investors from both regions in the US market. This change in investment focus may also be influenced by a decrease in confidence in the local and Asia-Pacific economies, as highlighted in the preceding sections.

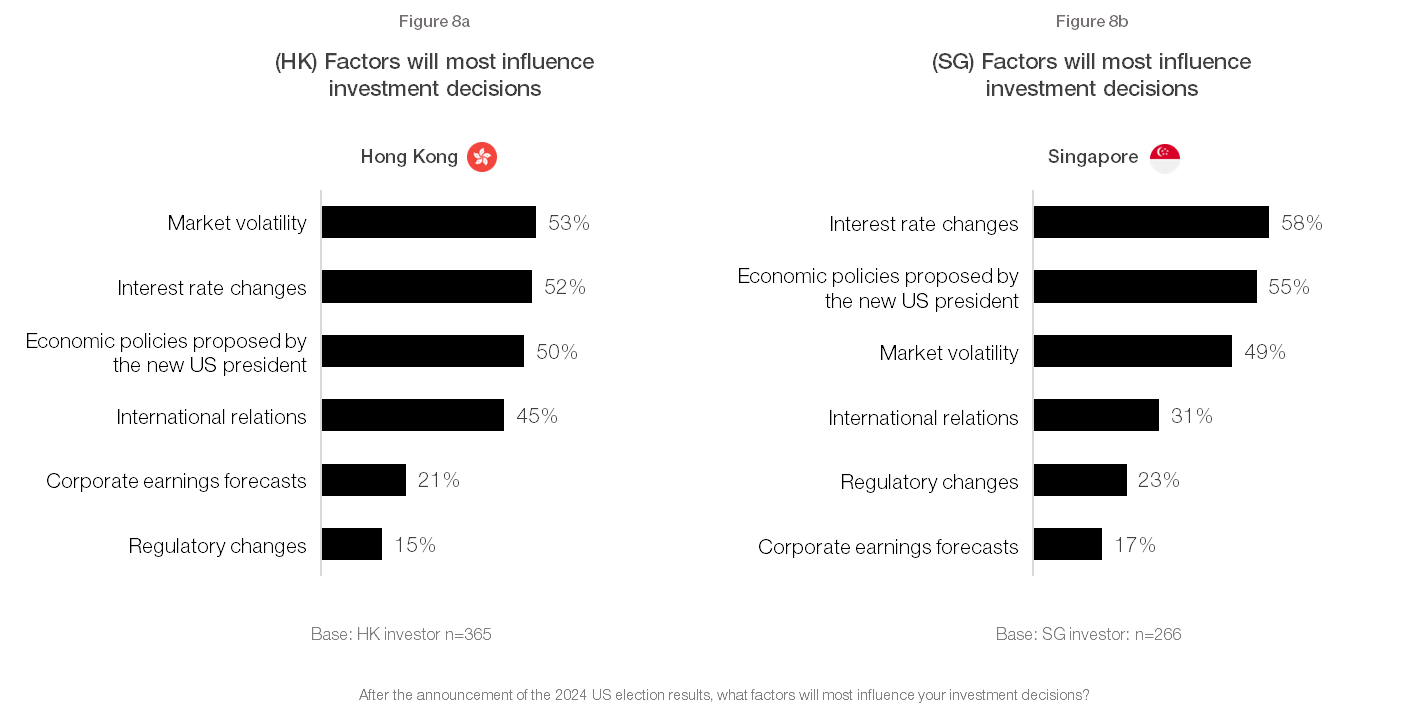

Key factors influencing investment decisions for Hong Kong investors include market volatility (53%), interest rate changes (52%), and Trump's economic policies (50%). In Singapore, the pivotal considerations are interest rate changes (58%) and economic policies (55%), with Hong Kong investors placing greater emphasis on international relations (45%) compared to their Singaporean counterparts (31%) (See figures 8a and 8b).

Simon Tye, CEO of MDRi, commented: "Our survey results show clearly how the election of Donald Trump is shaping investor sentiment in Hong Kong and Singapore. While Hong Kong investors demonstrate a more bullish outlook towards the US market, Singaporean investors express notable caution. These differing perspectives highlight the impact of geopolitical dynamics on local economic confidence, which businesses must navigate in the evolving landscape."

Hashtag: #MDRi

The issuer is solely responsible for the content of this announcement.

About The Mishcon de Reya Group

The Mishcon de Reya Group is an independent, international professional services business with law at its heart, employing over 1450 people with over 650 lawyers. It includes the law firm Mishcon de Reya LLP and a collection of leading consultancy businesses that complement the firm's legal services.

Mishcon de Reya LLP is based in London, Oxford, Cambridge, Singapore and Hong Kong (through its association with Karas So LLP). The firm services an international community of clients and provides advice in situations where the constraints of geography often do not apply. Its work is cross-border, multi-jurisdictional and complex, spanning seven core practice areas: Corporate; Dispute Resolution; Employment; Impact; Innovation; Private; and Real Estate.

The Mishcon de Reya Group includes consultancy businesses MDR Discover, MDR Mayfair (in London, Singapore and Dubai), MDR ONE, MDRi (in Hong Kong) and MDRx. The Group also includes MDR Lab, which invests in the most promising early stage legaltech companies as well as the Mishcon Academy, its in-house place of learning and platform for thought leadership.

Earlier this year, the Group announced its first strategic acquisition in the alternative legal services market, flexible legal resourcing business Flex Legal. It also acquired a majority stake in Somos, a global group actions management business.

About MDRi

Based in Hong Kong and with operations in London and Singapore, MDRi is a leading provider of business insights, empowering organizations with data-driven advice to make informed decisions and drive growth.

Through advanced analytics, industry expertise, and innovative methodologies, MDRi uncovers strategic opportunities, mitigates risks, and helps businesses stay ahead in a rapidly evolving marketplace. With a commitment to excellence and client-centricity, MDRi is revolutionizing the way organizations harness insights for success.