One such commonly used word is 'CFD'. The Octa experts explain what it is exactly and how the traders can profit from it below.

Understanding CFDs

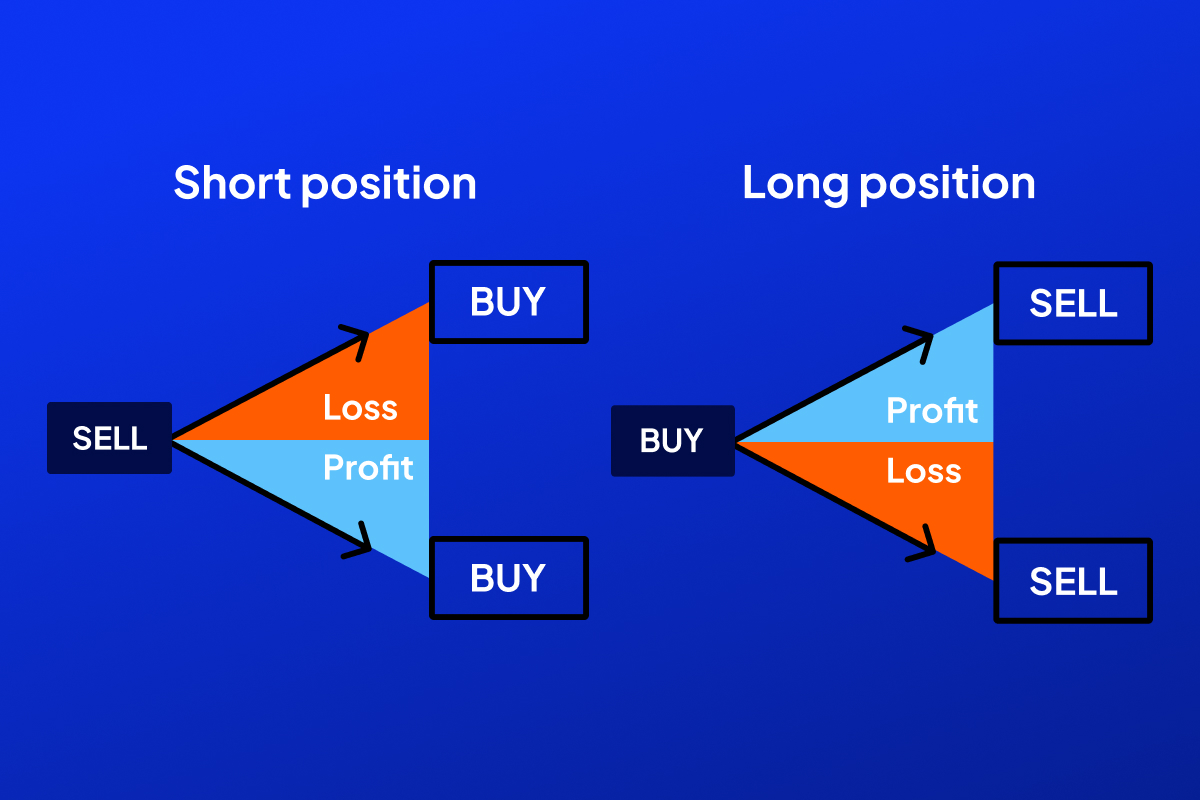

A contract for difference (CFD) is a derivative instrument that allows traders to speculate on the prices of various assets without actually owning them. CFDs are traded between traders and brokers, where the trader agrees to exchange the difference in the price of an asset from the time the contract is opened to when it is closed. In CFD trading, traders can profit from both rising and falling markets using long and short positions.

There are several types of assets you can trade with almost any CFD broker. Those include currencies, commodities (such as gold, silver, crude oil, natural gas, and others), indices, stocks, and cryptocurrencies. They are mostly represented in pairs, e.g. EURUSD, XAUUSD, BTCUSD. Indices and stocks have ticker symbols, such as NAS100 (Nasdaq 100), AMZN (Amazon), and TSLA (Tesla).

Pros and cons of CFD trading

Like any form of trading, CFD trading has its own set of advantages and disadvantages.

Advantages of CFD trading

- Leverage. CFDs offer high leverage, meaning traders can control a larger position with a relatively small capital. A deposit of $100 with a leverage of 1:500 will allow opening market orders worth $50,000. In this way, traders amplify their potential profits (but also their potential losses).

- Wide range of asset types. CFD brokers typically provide a wide range of financial instruments across different asset classes. Traders can diversify their portfolios with currencies, commodities, indices, stocks, and cryptocurrencies.

- Short selling. CFDs allow traders to profit from falling markets by short selling. The commissions and margin requirements for short positions are lower than in stock trading, while the leverage is generally higher.

- No ownership. Since CFD traders don't actually own the underlying assets in the contract, they don't have to deal with issues like their physical delivery, storage, or any kind of legal paperwork and bureaucracy.

- Accessibility. CFD trading platforms are easily accessible and often offer various trading tools, educational opportunities, and advanced analytics. The minimum recommended deposit is $100, which is lower than most conservative investments.

- Hedging. Traders can use CFD trading to offset some of their losses in other portfolios.

- High risk. CFD trading involves high leverage levels, which can lead to substantial losses if the market moves against the trader. Risk management techniques help reduce the risk levels involved in trading dramatically, and yet they cannot eliminate them completely.

- Complexity. CFD trading requires at least a general understanding of global financial markets and how certain factors influence asset prices. To open their first order, a trader will need a sound knowledge of price charts, trading platform functionality, and risk-limiting tools (including Stop Loss and Take Profit orders). However, this information is readily available with most CFD brokers.

- Stress. Such feelings as fear, greed, and various biases can significantly influence your trading decisions, pushing you to open an order or to close it at a random moment dictated only by your emotions. It is, therefore, crucial for traders to maintain strict trading discipline and open new orders only after a considerable analysis has been performed.

Simply put, a CFD broker, such as Octa, is a service that provides intermediary services between an individual trader and the global markets. Retail traders cannot execute orders there on their own when it comes to financial markets with trillions of U.S. dollars in daily turnover. CFD brokers give access and all the necessary tools for market participation, including trading instruments, platforms, indicators, analytics, educational materials, and much more.

CFD trading costs

The three most common fees in CFD trading are spreads, swaps, and per-trade commissions.

The spread is the difference between a CFD's buy (bid) and sell (ask) price. It is the main fee the broker profits from and one of the most significant costs in CFD trading. The tighter the spread, the lower the cost of trading. Brokers often offer floating spreads that can change depending on market conditions.

Swaps or overnight funding fees are charged for holding a position overnight. They depend on the interest rate differential between the currencies in a pair, called the swap rate. Swaps depend on the direction of the order (short or long) and are usually charged at midnight. On Wednesday night, traders have to pay weekend swaps, which are triple the usual size because it is accrued over two additional days—Saturday and Sunday.

Commissions are charged on each trade. This fee is separate from the spread and is typically a fixed amount per lot or trade. The commission cost varies among brokers and may depend on the type of CFD being traded.

To enhance trading opportunities and make trading more accessible for its clients, Octa decided not to charge any fees except for spreads.

It's essential to carefully read and understand the terms and conditions provided by your chosen CFD broker. Before the one starts trading, it’s crucial to consider the total cost of trading, including spreads, commissions, swaps, and any other fees. Additionally, the one should be aware of how leverage can magnify both potential profits and losses, which can significantly impact overall trading costs. It is crucial to evaluate these costs to manage risk and maximise potential returns in CFD trading.

Hashtag: #Octa

The issuer is solely responsible for the content of this announcement.

About Octa

Octa is an international broker that has been providing online trading services worldwide since 2011. It offers commission-free access to financial markets and various services already utilised by clients from 180 countries with more than 42 million trading accounts. Free educational webinars, articles, and analytical tools they provide help clients reach their investment goals.

The company is involved in a comprehensive network of charitable and humanitarian initiatives, including the improvement of educational infrastructure and short-notice relief projects supporting local communities.

Octa has also won more than 60 awards since its foundation, including the ‘Best Online Broker Global 2022’ award from World Business Outlook and the ‘Best Global Broker Asia 2022’ award from International Business Magazine.