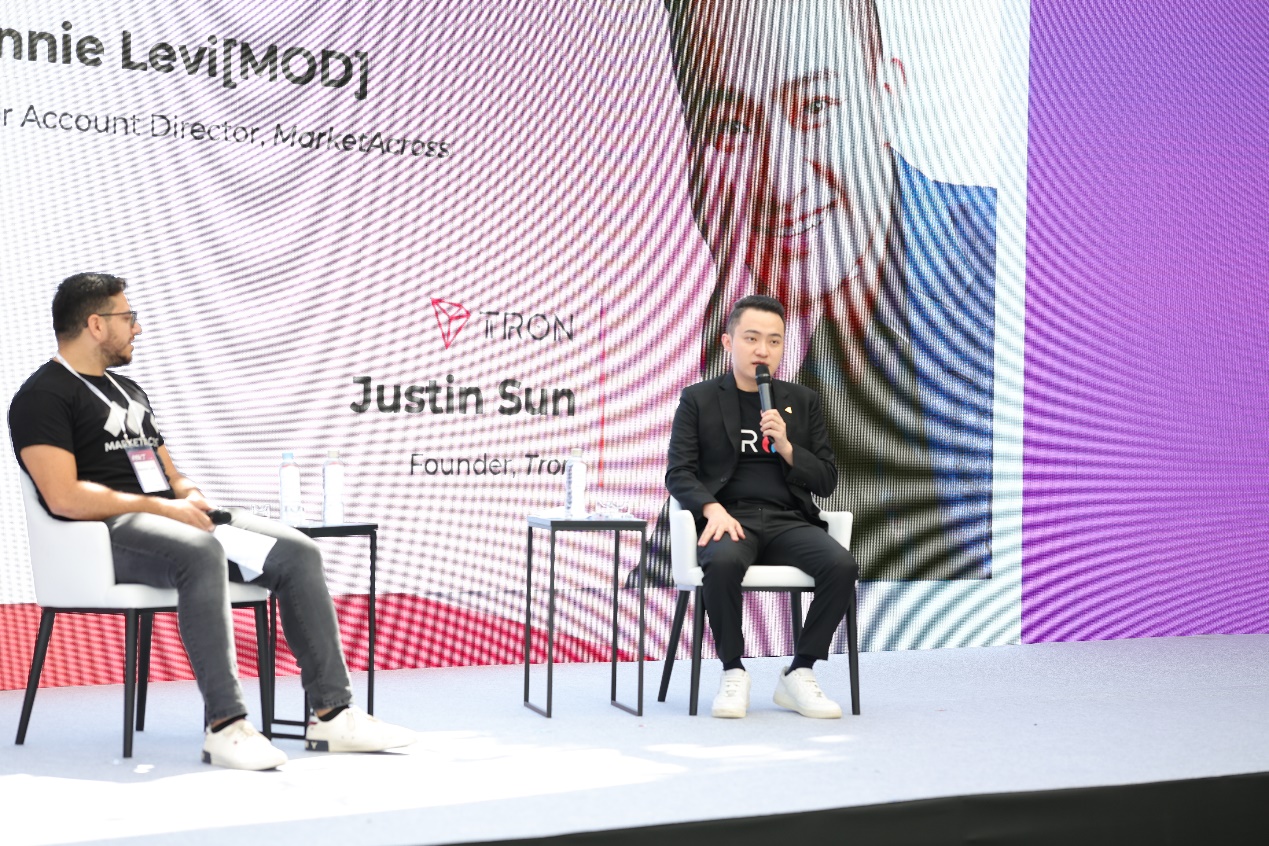

During the conversation, Sun articulated that despite aggressive suppression policies by the United States, cryptographic technology remains a global strategic initiative in which all stakeholders will inevitably partake. Dollar-pegged Stablecoins will continue to manifest robust momentum in Asia, predominantly attributed to the region's regulatory landscape. This trend will persist into the Web 3.0 era, and concurrently, Asian narratives are poised to reestablish their mainstream prominence.

Crypto Firms Vie for Asian Market Share, Catalyzing Accelerated Growth in the Global Sector

During the conversation, Justin Sun elucidated that South Korea represents a somewhat insular region within the cryptographic landscape, showing modest enthusiasm for Decentralized Finance (DeFi). However, for technology developers, the South Korean market retains considerable significance. Consequently, TRON places high emphasis on the South Korean jurisdiction. Currently boasting the largest circulation of USDT within the TRON network, it is also poised to champion stUSDT as the preeminent DeFi protocol.

At present, dollar-pegged stablecoins continue to exhibit robust performance in the Asian markets, emerging as the dominant stablecoin within the region. Justin Sun attributes this phenomenon to Asia's regulatory landscape, particularly in stringently regulated nations such as South Korea and China. An increasing number of individuals are opting to hold stablecoins in Asia, furnishing crypto firms with significant market opportunities.

Justin Sun highlighted that Hong Kong, a pivotal player in the Asian cryptocurrency market, has experienced fluctuations. While it was once a favored hub for cryptocurrency exchanges, the tightening of cryptocurrency policies in China led to the attrition of several high-caliber projects. Recently, however, the Hong Kong government has adopted more accommodating policies in an attempt to rejuvenate its appeal for cryptocurrency enterprises. This competitive dynamic has also galvanized Singapore into action to preserve its regional leadership. The interplay of rivalry between Hong Kong and Singapore stands to invigorate the global cryptocurrency industry, offering a broader array of options for investors and entrepreneurs alike.

Additionally, the global cryptocurrency landscape is undergoing turbulent shifts, with regulatory climates and waves of innovation in constant flux. Actions taken by the United States Securities and Exchange Commission (SEC) are compelling certain projects to recalibrate their focus towards Asia and other regions, facilitating greater decentralization. This aligns well with the quintessential ethos of cryptographic assets, which emphasizes decentralization and global protocols. The current evolutionary stage of cryptocurrencies mirrors the nascent phases of the internet, destined to permeate global landscapes eventually. Justin Sun emphasized that cryptographic platforms, including TRON, should proactively engage in global strategies, allocating resources not only in the United States but also in regions such as South Korea, Japan, and Southeast Asia, to catalyze the accelerated growth of the worldwide cryptocurrency market.

The Cryptocurrency Sector Sustains Innovation: Market Poised to Enter a New Cycle in the Forthcoming Two Years

Amidst a bear market that has persisted for over a year, Justin Sun maintains an optimistic outlook, forecasting that the market is poised to enter a new bull cycle within the forthcoming two years. The industry has been undergoing a deleveraging process over the past year, requiring time to absorb the market shocks stemming from liquidity crises faced by companies such as 3AC and FTX.

Justin Sun believes that the industry at large equally requires time to rebuild confidence and sustain development. On a personal note, this year marks his 11th in entrepreneurship; while most of his peers have opted for retirement, he remains invigorated by the novel developments emerging daily. Over a decade of industry evolution has yielded a plethora of innovative products, stablecoins being one such example. These have enabled everyone to engage in on-chain transactions in a convenient, cost-effective manner. In the case of TRON, approximately two million individuals utilize the network for transfers daily; while they may not be fully aware of its underlying mechanics, this has already established a palpable trend. Other recent developments, such as RWA, ZK, and LSD, may not yet have made a lasting impression on the majority, primarily due to the prevailing bear market that naturally dampens enthusiasm and diverts attention from fresh industry movements.

Justin Sun asserts that during a bear market, it is imperative for everyone to continue building and to assist other companies and projects mired in challenges. He divulged that he has recently not only aided the DeFi protocol Curve in resolving its financial complications but has also persuaded numerous acquaintances to invest in Curve, citing that "developers are one of the most vital cornerstones in the industry."

TRON boasts an exceptionally robust DeFi and stablecoin ecosystem, poised to facilitate collaborative user experiences, a feature that serves to mitigate transactional costs and represents a communal advantage. "Beyond principal and independent developers, we are also very open to assisting others in development on the TRON platform," Justin Sun articulates.

Hashtag: #TRON

The issuer is solely responsible for the content of this announcement.